Are you struggling to find the best car insurance that offers both comprehensive coverage and great value?

With countless options available, choosing the right policy can be overwhelming.

The right car insurance not only provides financial protection in case of accidents but also offers peace of mind with added benefits and superior customer service.

To help you make an informed decision, we have identified the top five car insurance companies for 2024, each excelling in different aspects to cater to your unique needs.

Read on to discover which insurers made the list and why they stand out in the competitive market.

Are you searching for the perfect car insurance but unsure where to start? With so many options available, finding the right fit can feel overwhelming. In this article, we’ll dive into the top five car insurance companies—State Farm, Travelers, Amica Mutual, USAA, and Geico. We’ll explore their strengths, from agent accessibility to claims handling and competitive quotes, helping you make an informed choice. Let’s break down what sets these industry leaders apart and discover which one is best suited for your needs.

State Farm 【Agent・Claim・Quote】

(references https://www.statefarm.com/insurance/auto)

Overview: State Farm is a top choice for young drivers and those seeking customizable insurance plans.

The company offers a wide range of coverages and discounts, making it a versatile option for various driver needs. State Farm is also highly rated for its customer service and claims satisfaction.

Features:

- Customizable Plans: State Farm offers numerous coverage options, including liability, collision, comprehensive, and uninsured motorist coverage.

- Discounts for Young Drivers: State Farm provides several discounts specifically for young drivers, such as good student and driver training discounts.

- Strong Financial Ratings: The company boasts strong financial stability and high marks in customer satisfaction and claims handling.

Average Annual Premium: $1,976 (Money) (Insure.com).

Pros:

- Wide range of coverage options

- High customer satisfaction

- Numerous discounts available

Cons:

- Higher premiums compared to some competitors

- Fewer discounts than some other insurers

Finding State Farm Insurance Near Me

When it comes to choosing an insurance provider, convenience and accessibility are crucial factors. State Farm, one of the leading insurance companies in the United States, has numerous local branches to ensure that their customers receive personalized service and support. Here’s how to find State Farm insurance near you and why it’s beneficial to have a local agent.

Why Choose a Local State Farm Agent?

Having a local State Farm agent offers several advantages:

- Personalized Service: Local agents understand the specific needs of your community and can tailor insurance policies accordingly.

- Convenience: With a nearby office, you can easily visit in person to discuss your insurance needs or address any issues.

- Local Knowledge: Agents who live and work in your area have a better understanding of local risks and can recommend appropriate coverage.

How to Find a State Farm Agent Near You

- Use the State Farm Website: Visit the State Farm website and use their agent locator tool. Enter your ZIP code or city and state to find agents in your area.

- Mobile App: Download the State Farm mobile app, which also has a feature to locate nearby agents.

- Google Search: A quick search on Google for “State Farm near me” will provide you with a list of local agents and their contact information.

- Customer Service: Call State Farm’s customer service line, and they can assist you in finding the nearest agent.

Having a local State Farm agent not only ensures that you get the best advice tailored to your location but also provides a trusted contact for all your insurance needs.

How to File a Claim with State Farm

Filing an insurance claim can be a stressful process, but State Farm strives to make it as straightforward and hassle-free as possible. Whether you’ve had a car accident, property damage, or another covered event, here’s a step-by-step guide to filing a claim with State Farm.

Steps to File a Claim

- Report the Claim:

- Online: Log in to your account on the State Farm website and follow the prompts to report a claim.

- Mobile App: Use the State Farm mobile app to file a claim quickly and easily.

- Phone: Call the State Farm claims department at 1-800-SF-CLAIM (1-800-732-5246).

- Gather Information: Collect all necessary information related to the incident, including photos, police reports, and any other relevant documents.

- Follow Up: After reporting your claim, a State Farm claims representative will contact you to discuss the details and next steps.

- Repair and Recovery: Depending on the nature of your claim, State Farm will guide you through the repair or recovery process, including finding a repair shop or contractor if needed.

- Payment: Once your claim is approved, State Farm will process your payment promptly.

Tips for a Smooth Claims Process

- Document Everything: Keep detailed records of the incident and all communications with State Farm.

- Be Prompt: Report your claim as soon as possible to avoid any delays.

- Follow Instructions: Adhere to the guidance provided by your claims representative to ensure a smooth process.

State Farm is committed to helping you get back on track quickly and efficiently after an unfortunate event.

Getting a Quote from State Farm

Whether you’re looking for auto, home, or life insurance, getting a quote from State Farm is a simple process that can be done online, through their mobile app, or by visiting a local agent. Here’s how to get an accurate insurance quote tailored to your needs.

Steps to Get a Quote

- Visit the State Farm Website: Go to the State Farm website and select the type of insurance you need. Click on “Get a Quote” and follow the prompts to enter your information.

- Use the Mobile App: Download the State Farm mobile app and use it to get a quote quickly.

- Call an Agent: Contact a local State Farm agent who can provide a personalized quote based on your specific needs.

- Visit a Local Agent: For a more personalized experience, visit a local State Farm office and discuss your insurance needs in person.

Information You’ll Need

- Personal Information: Name, address, and contact details.

- Vehicle Information: If you’re getting an auto insurance quote, you’ll need details about your vehicle, such as make, model, year, and VIN.

- Property Information: For home insurance, provide details about your property, including location, size, and any special features.

- Coverage Needs: Be clear about the type of coverage you’re looking for and any specific needs or preferences you have.

Benefits of Getting a Quote from State Farm

- Competitive Rates: State Farm offers competitive rates and various discounts to help you save money.

- Comprehensive Coverage: With a wide range of insurance products, State Farm can provide comprehensive coverage to protect what matters most to you.

- Expert Advice: State Farm agents are knowledgeable and can help you choose the right coverage for your needs.

Getting a quote from State Farm is the first step towards securing reliable and affordable insurance coverage.

For more details and to get started, visit the State Farm website or contact a local agent today.

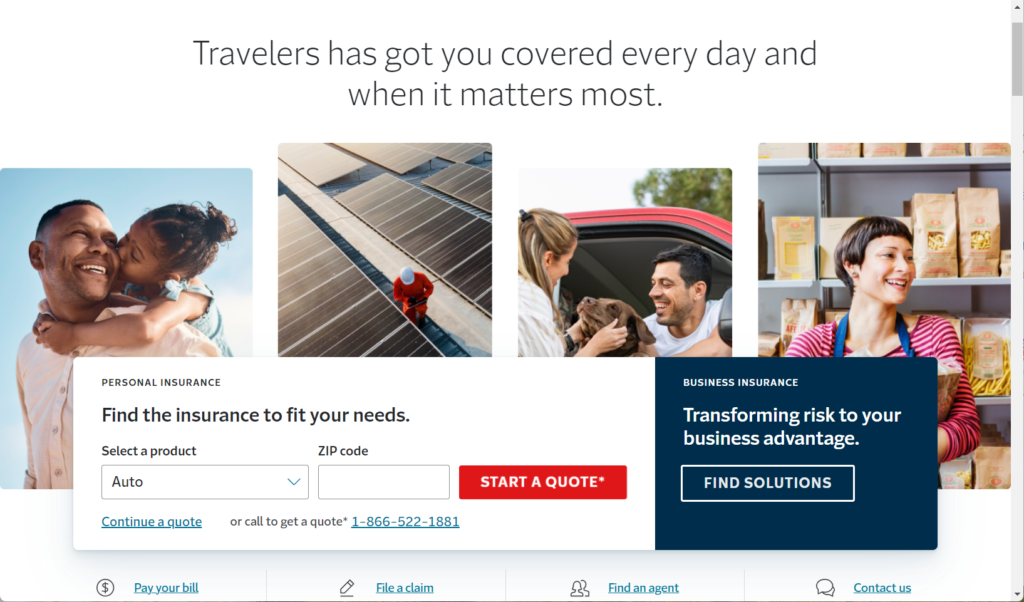

Travelers 【Quote・Claim・Agent】

(references https://www.travelers.com/)

Overview: Travelers stands out as the top overall car insurance company in 2024. Known for its extensive range of coverage options and competitive discounts, Travelers is an excellent choice for drivers looking for customizable insurance plans. The company has received fewer customer complaints than expected for its size, indicating a strong performance in customer satisfaction.

Features:

- Comprehensive Coverage: Travelers offers a variety of coverage options including liability, collision, comprehensive, and more specialized coverages like gap insurance and new car replacement.

- Discounts: The company provides numerous discounts, such as multi-policy, safe driver, and homeownership discounts, helping policyholders save on their premiums.

- Customer Service: With a strong financial rating and a robust claims process, Travelers is a reliable choice for those seeking stability and excellent service.

Average Annual Premium: $1,681 (NerdWallet: Finance smarter) (Money).

Pros:

- Wide range of coverage options

- Multiple discounts available

- Fewer customer complaints

Cons:

- Customer satisfaction ratings are average

- Rideshare insurance not available in all states

Getting a Quote from Travelers Insurance

Whether you’re looking to insure your home, car, or business, getting a quote from Travelers Insurance is a simple and straightforward process. Here’s how you can obtain a tailored insurance quote that meets your specific needs.

Steps to Get a Quote

- Visit the Travelers Website:

- Navigate to the Travelers Insurance website.

- Choose the type of insurance you need: auto, home, business, or another type.

- Enter Your Information:

- Provide basic information such as your name, address, and contact details.

- For auto insurance, you’ll need details about your vehicle, including make, model, year, and VIN.

- For home insurance, provide details about your property, such as location, size, and special features.

- Customize Your Coverage:

- Select the coverage options that best suit your needs. This may include liability, collision, comprehensive, and additional coverages for auto insurance or specific protections for your home or business.

- Review and Submit:

- Review the information you’ve entered to ensure accuracy.

- Submit your request to receive your quote.

- Get Your Quote:

- You will receive a personalized insurance quote based on the information provided. You can review this quote online or have it sent to your email.

Benefits of Getting a Quote from Travelers

- Competitive Rates: Travelers offers competitive pricing and various discounts to help you save money.

- Comprehensive Coverage: With a wide range of insurance products, you can find comprehensive coverage for all your needs.

- Expert Advice: Travelers’ agents are knowledgeable and can help you choose the right coverage for your situation.

How to File a Claim with Travelers Insurance

Filing an insurance claim can be a daunting task, but Travelers Insurance makes it as simple and stress-free as possible. Here’s a step-by-step guide to help you through the process.

Steps to File a Claim

- Report the Claim:

- Online: Log in to your account on the Travelers Insurance website and follow the prompts to report a claim.

- Mobile App: Use the Travelers mobile app to file a claim quickly and easily.

- Phone: Call the Travelers claims department at 1-800-252-4633.

- Gather Information:

- Collect all necessary information related to the incident, such as photos, police reports, and any other relevant documents.

- Follow Up:

- A Travelers claims representative will contact you to discuss the details of your claim and guide you through the next steps.

- Repair and Recovery:

- Depending on the nature of your claim, Travelers will assist you in the repair or recovery process. This may include finding a repair shop or contractor.

- Payment:

- Once your claim is approved, Travelers will process your payment promptly.

Tips for a Smooth Claims Process

- Document Everything: Keep detailed records of the incident and all communications with Travelers.

- Be Prompt: Report your claim as soon as possible to avoid any delays.

- Follow Instructions: Adhere to the guidance provided by your claims representative to ensure a smooth process.

Finding a Travelers Insurance Agent Near You

Having a local insurance agent can make a significant difference in your insurance experience. Here’s how to find a Travelers Insurance agent near you.

Steps to Find a Local Agent

- Use the Travelers Website:

- Visit the Travelers Insurance agent locator on their website.

- Enter your ZIP code or city and state to find agents in your area.

- Mobile App:

- Download the Travelers mobile app, which also has a feature to locate nearby agents.

- Google Search:

- A simple search for “Travelers insurance agent near me” will provide you with a list of local agents and their contact information.

- Customer Service:

- Call Travelers’ customer service at 1-800-842-5075 for assistance in finding the nearest agent.

Benefits of a Local Agent

- Personalized Service: Local agents understand the specific needs of your community and can tailor insurance policies accordingly.

- Convenience: Having an agent nearby makes it easy to visit in person to discuss your insurance needs or address any issues.

- Local Knowledge: Agents who live and work in your area have a better understanding of local risks and can recommend appropriate coverage.

By following these steps, you can find a Travelers Insurance agent who will provide you with personalized service and support for all your insurance needs. For more information and to get started, visit the Travelers Insurance website.

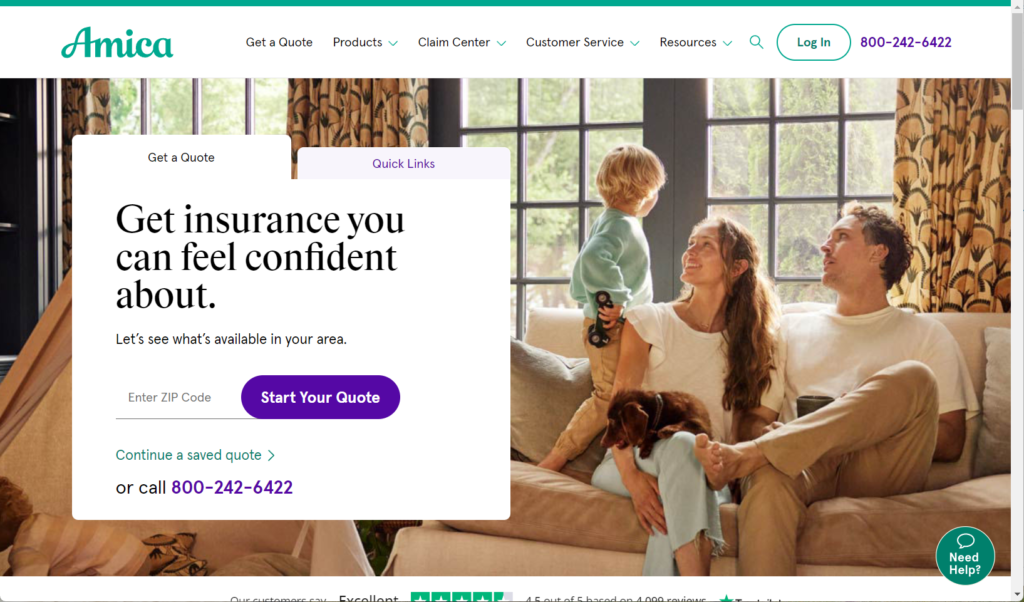

Amica Mutual

(references https://www.amica.com)

Overview: Amica Mutual is celebrated for offering the best car insurance package, particularly with its Platinum Choice Auto policy. This package includes numerous unique benefits that set it apart from other insurers, such as free airbag replacement, lock replacement if your keys are stolen, and identity fraud monitoring.

Features:

- Platinum Choice Auto Policy: Includes standard coverages plus perks like $0 out-of-pocket glass replacement and up to $5,000 in rental car coverage.

- Customer Rewards: Amica’s Advantage Points program allows policyholders to earn points for good driving, which can be used to reduce deductibles.

- Customer Satisfaction: High ratings in customer satisfaction and claims handling further bolster Amica’s reputation.

Average Annual Premium: $2,481 (Money) (PolicyGenius).

Pros:

- Extensive coverage options with unique benefits

- High customer satisfaction and claims satisfaction ratings

Cons:

- Higher than average premiums

- Limited availability of some features nationwide

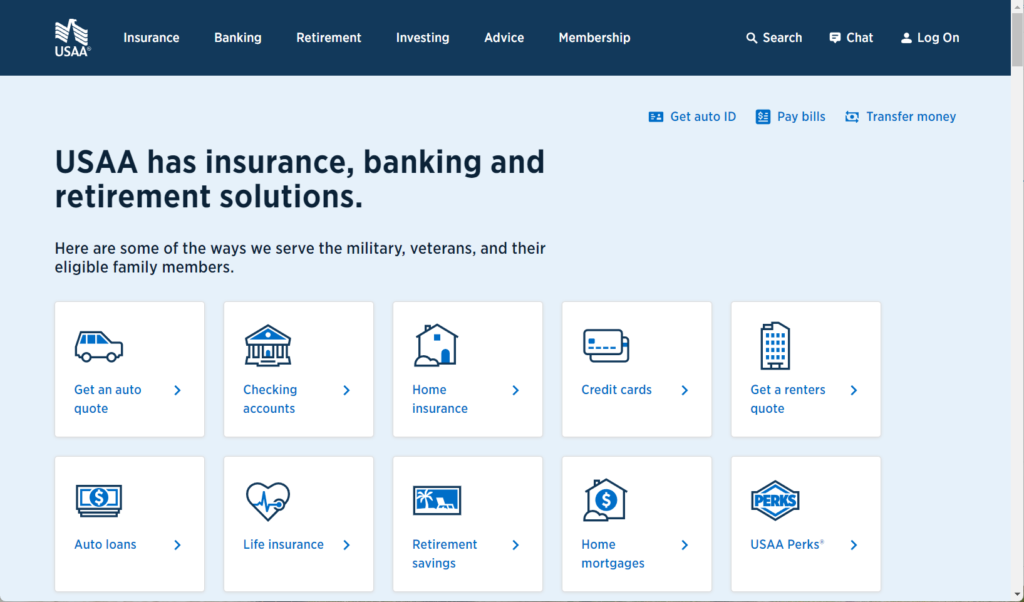

USAA

(references https://www.usaa.com/)

Overview: USAA is highly rated for its exceptional service to military members and their families. Known for its competitive rates and excellent customer service, USAA consistently receives top marks in customer satisfaction surveys. Although it is only available to military personnel and their families, it offers some of the best insurance products on the market.

Features:

- Exclusive Membership: USAA serves military members, veterans, and their families, offering tailored services and support.

- Comprehensive Coverage: Offers standard coverages along with specialized options like rideshare coverage and vehicle storage discounts.

- Financial Strength: USAA has a robust financial foundation and consistently high ratings for claims satisfaction and customer service.

Average Annual Premium: $1,432 (NerdWallet: Finance smarter) (Money).

Pros:

- Competitive pricing

- High customer satisfaction

- Comprehensive coverage options tailored to military families

Cons:

- Restricted to military members and their families

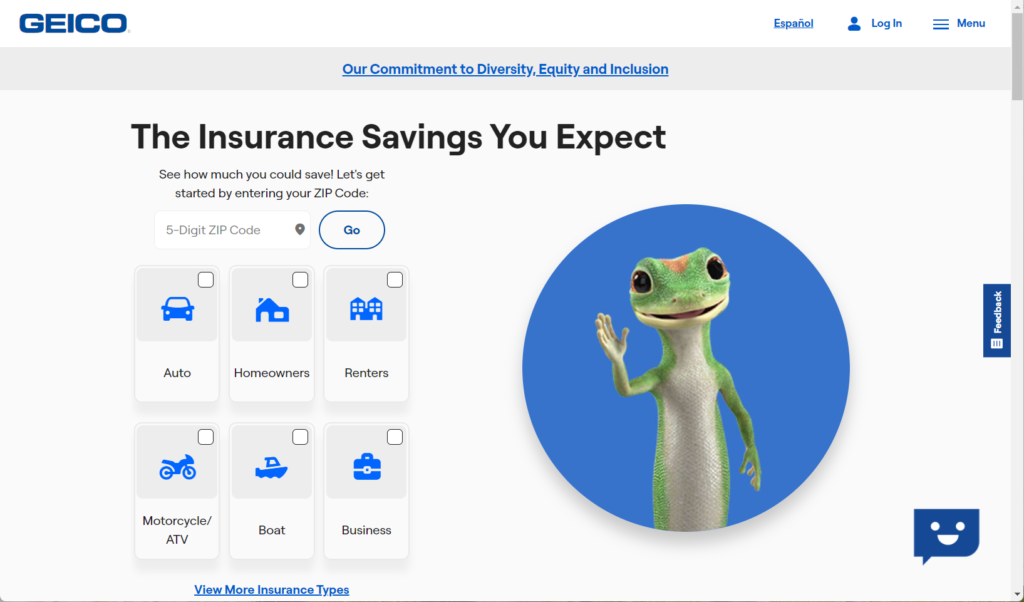

Geico

(references https://www.geico.com/)

Overview: Geico is renowned for its affordability and user-friendly digital tools. It offers some of the lowest rates in the industry and provides a variety of discounts, making it an attractive option for cost-conscious drivers. Geico’s mobile app and online services are highly rated, offering convenience for policy management and claims processing.

Features:

- Affordable Rates: Geico is known for its competitive pricing and multiple discount options, including good driver, multi-policy, and military discounts.

- Digital Tools: The Geico mobile app and online platform are user-friendly, providing easy access to policy information, bill payments, and claims filing.

- Wide Availability: Geico offers coverage in all 50 states and the District of Columbia.

Average Annual Premium: $1,846 (PolicyGenius) (Insure.com).

Pros:

- Low premiums

- Excellent digital tools

- Wide range of discounts

Cons:

- Limited availability of certain coverage options

- Some products underwritten by third parties

Conclusion

Choosing the right car insurance involves assessing your personal needs, driving history, and budget. The top five car insurance companies for 2024 offer a variety of strengths, from comprehensive coverage and unique perks to affordable rates and excellent customer service. By comparing quotes and considering the specific features and benefits each company offers, you can find the best policy to protect you on the road.